BNPL Solutioning

A comprehensive analysis of Buy Now, Pay Later business models, ecosystem dynamics, and strategic differentiation for executives.

Buy Now, Pay Later

Flexible payment solutions for modern commerce

BNPL Business Model

Understanding the core business model and operational dynamics of Buy Now, Pay Later solutions

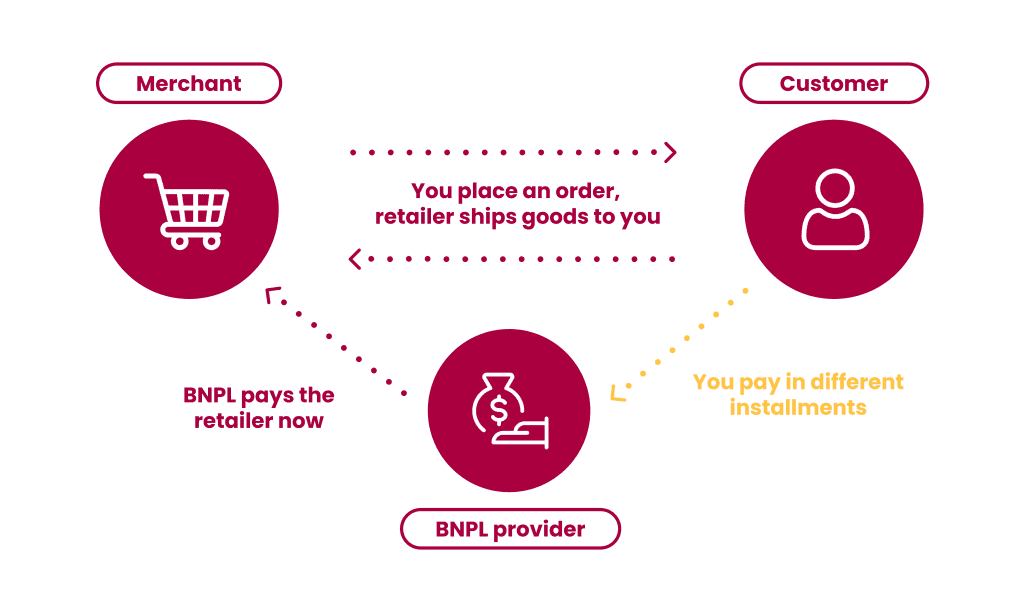

Basic BNPL Model

- Enables deferred payments for purchases.

- Offers installment payment options.

- Often features interest-free short-term plans.

- Aims for a mutually beneficial ecosystem.

Major BNPL Operators

The BNPL landscape features a diverse range of operators, from agile Fintechs to established Banks, each serving distinct B2B or B2C market segments.

Fintech Lenders

e-Wallet

ERP SaaS

Neobanks & Challenger Banks

Traditional Banks

Retailer and Merchant

Suppliers & Marketplace

Key Characteristics

Business Perspective

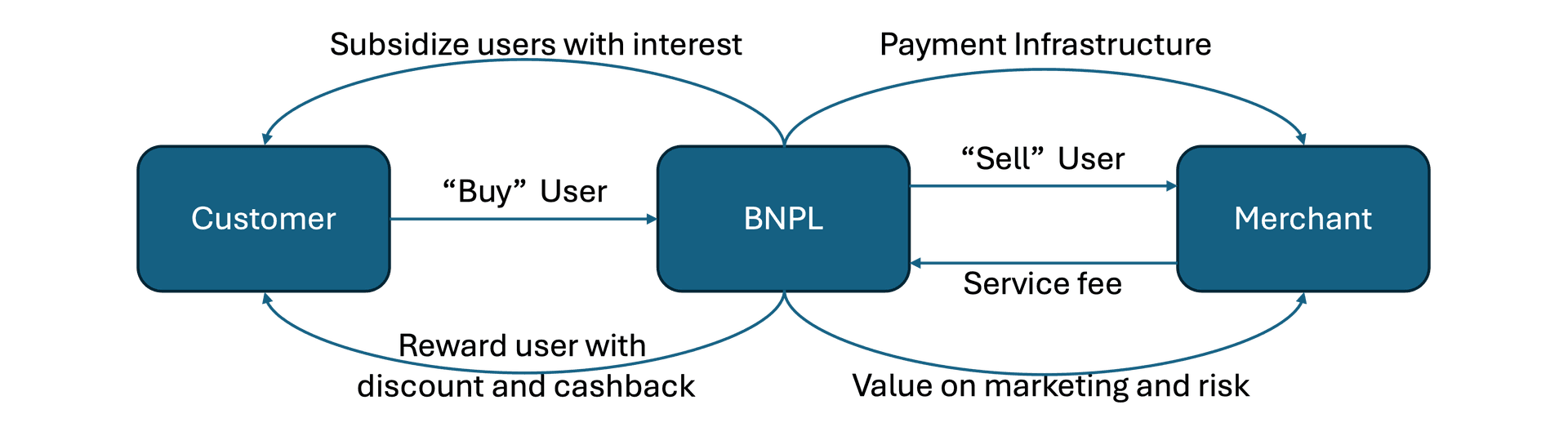

- Product perspective: BNPL is primarily a lending product, offering short-term credit to consumers or businesses.

- Operational perspective: It functions akin to a payment processing business, focusing on seamless integration and high transaction volumes.

- Ultimate goal: To achieve significant operational scale and market share, often leveraging platform network effects for growth.

Competitive Landscape

| Traditional Banks | Fintech Players | |

|---|---|---|

| Operating Environment | Operate within regulatory boundaries | Innovate at the regulatory edge |

| Competitive Levers | Leverage low-cost capital and wholesale infrastructure | Capitalize on speed and user-centric product design |

| Value Proposition | Offer structural scale and institutional trust | Deliver agile, embedded financial solutions |

| Digital Strategy | Face execution gaps in lightweight, digital-first delivery | Build natively digital products tailored to underserved segments |

| Risk Approach | Prioritize risk minimization and compliance | Embrace controlled risk to unlock new market opportunities |

The Operational Essence of BNPL

Value Proposition (B2C)

Merchant

- Acquiring capabilities & increased conversion rates for merchants.

- Marketing tools & access to a new customer base.

- Improved financial management and cash flow for businesses.

- Valuable data analytics & customer insights.

- Other value-added services like fraud prevention.

Customer

- Flexible installment payments, reducing short-term financial pressure.

- Interest-free or low-interest plans, increasing purchasing power.

- Simple and fast application and repayment process.

- Transparent fee structure, no hidden costs.

- Credit building opportunities (for some BNPL products).

Revenue & Profit Structure (B2C)

Revenue Sources:

Profit Formula:

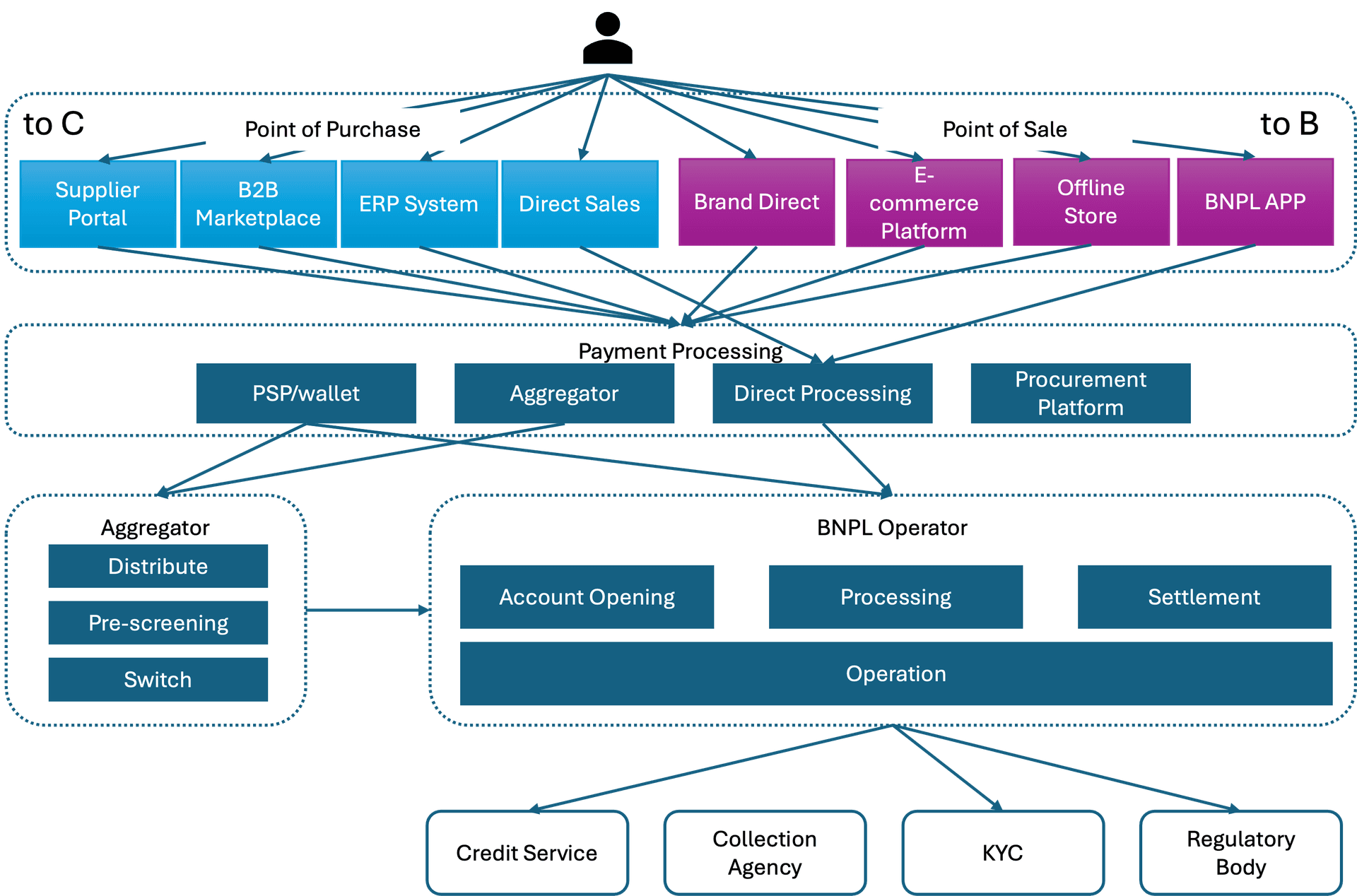

BNPL Ecosystem Analysis

Understanding the interconnected roles and relationships within the BNPL value chain

The BNPL Transaction Chain

The BNPL ecosystem comprises five key positions that enable real-time transactions:

1Users (Consumers & Buyer)

The end consumers using BNPL services to make purchases and manage payments over time.

2Point of Sales

Covers B2C retail (websites, apps, physical stores) and B2B platforms (e-commerce, supplier portals, integrated invoicing/ERP).

3Payment Processing

Integration with payment systems that connects the user experience with the BNPL service, appearing as a payment option.

4Aggregators

Act as BNPL integrators and distributors, helping expand the network and simplify merchant integration — essentially PSPs for the BNPL sector.

5BNPL Operators

The actual fund lenders in the business, providing the financial backing for transactions.

6Peripheral Services (Consumer Credit)

Encompasses credit/data providers (for B2C/B2B risk), technology solutions (underwriting, security), collection agencies, and regulatory bodies for compliance.

Operating Models

Different operators occupy various ecosystem positions based on their capabilities, forming unique business models.

| Feature | Closed-Loop Model | Open-Loop Model |

|---|---|---|

| Participants | Specific retailer or platform | Open, usable across multiple merchants |

| Scope | Narrow, limited to specific merchants/partners | Broad, usable at merchants accepting the BNPL payment method |

| Data Control | Strong, retailer/platform owns complete data | Shared, data potentially shared among provider, financial institutions, merchants |

| Merchant Fee | Generally lower | Generally higher |

| User Stickiness | Stronger | Relatively weaker |

| Risk Control/Approval | Customized | Standardized |

| User Coverage | Relatively narrow | Broader |

| Representative Brands | Amazon Pay Later, some brand-specific installment plans | Klarna (some features), Affirm, Afterpay, PayPal "Pay in 4" |

Adapting to Market Needs

No single BNPL model dominates across contexts.

| Model Type | B2C BNPL | B2B BNPL |

|---|---|---|

Comprehensive Ecosystem | Direct-to-consumer + wide merchant base → Full-stack platform with brand-led demand generation. E.g., Klarna, Affirm | Emerging in B2B marketplaces & platforms → Aims to unify buyers and suppliers with embedded finance & procurement tools. E.g., Resolve, B2B marketplaces |

Financial Institution Model | Bank-led BNPL via cards or accounts → Leverages trust, low cost of funds, often via fintech partners. E.g., Barclays + fintech | Commercial banks or funders behind fintech rails → Provides credit to SME buyers or suppliers via integrations or partnerships. E.g., HSBC, Citi with APIs |

Embedded / White-Label | Retailers embed BNPL into checkout → Customer-facing, often powered by third-party BNPL. E.g., Apple Pay Later (Goldman) | BNPL woven into e-commerce/ERP flows → Frictionless B2B UX, no visible lender brand. E.g., embedded in SAP, Shopify B2B, industry platforms |

Banks Key Considerations & Capability Gaps in B2B BNPL

Banks entering B2B BNPL must navigate the shift from traditional relationship-based credit cycles to the fast, API-driven, transactional models pioneered by fintechs.

1. Key Considerations for Banks

Customer Expectations

Real-time decisioning, seamless digital UX, embedded flows into existing procurement or sales platforms.

Product Design Philosophy

BNPL is often a workflow product, deeply integrated at point of need, rather than a standalone traditional loan or credit line.

Risk Appetite & Underwriting

Involves managing potentially short-tenor, high-frequency, and sometimes unsecured credit for diverse business profiles.

Go-to-Market Speed & Agility

Requires iterative product development cycles and rapid deployment, contrasting with traditional annual release schedules.

Technology Architecture

Needs an API-first, modular technology stack. Legacy core banking systems can limit the agility required for BNPL.

Regulatory & Compliance Landscape

Navigating evolving regulations for BNPL, ensuring responsible lending, and managing AML/KYB for businesses.

2. Potential Capability Gaps

| Capability Area | Typical Bank Limitation | Modern BNPL Requirement (Fintech Advantage) |

|---|---|---|

| Onboarding & KYB/KYC | Often manual, paper-based, and slower processes. | Instant, automated, digital-first onboarding & verification. |

| Credit Decisioning | Periodic reviews, static models, often relationship-based. | Dynamic, real-time, transaction-level risk assessment using diverse data sources. |

| System Integration (ERP/Platform) | Limited, rigid, or costly custom integrations. | Plug-and-play APIs, SDKs for seamless embedding into business workflows. |

| User Experience (UX) & Workflow | Often generic, external to core business processes. | Embedded, contextual, intuitive UX within existing user journeys. |

| Data Utilization & Agility | Data often siloed, batch-processed, delayed insights. | Real-time data aggregation, behavioral scoring, rapid iteration based on analytics. |

3. Strategic Path Forward for Banks

- Partner with/acquire fintechs for agile tech & specialized engines.

- Decouple from legacy core via modular, API-driven architecture.

- Reframe B2B BNPL as working capital solutions & value-added services.

- Embed financing into procurement, B2B marketplaces & ERPs.

- Develop industry-specific B2B BNPL for unique sector needs & risks.

BNPL Product Forms

Exploring the diverse range of BNPL product offerings and their unique characteristics

Understanding B2C vs. B2B BNPL

B2C BNPL

- After purchasing products, consumers apply to pay in 4 installments

- BNPL provider makes the upfront payment to the merchant

- Consumers pay the amount in four installments within 60 days, interest-free

- The BNPL service provider charges merchants a service fee

B2B BNPL

- Business buyer places an order on a supplier's platform or B2B marketplace, opting to "Buy Now, Pay Later" (e.g., 30/60/90 days).

- BNPL provider pays the supplier upfront, often at a discount (e.g., 97-99% of invoice value).

- Buyer repays the BNPL provider at the agreed deferred term, potentially with interest or fees depending on duration and risk.

- BNPL provider earns revenue through supplier-side transaction fees and/or buyer-side interest, while offering working capital benefits to both parties.

Key Differences in Product Design and Delivery

BNPL Product Conditions vs Traditional Lending

B2C BNPL products are extremely simplified compared to traditional lending products.

Key Product Definition Elements

These five elements cover over 90% of all B2C BNPL product definitions:

- Interest rates

- Installment structures

- Repayment periods

- Late fees

- Merchant fees

Different B2C BNPL Product Forms

Form Name |

|---|

| Interest-Free Installments |

| Credit Line with Promotional Financing |

| Existing Credit Utilization |

| Flexible Payment Plans |

| Long-Term Financing Options |

| Specialized BNPL Services |

Different B2B BNPL Product Forms

Form Name |

|---|

| Digital Net Terms |

| Installment Plans for Businesses |

| Flexible Credit Lines |

| Invoice Financing (BNPL-style) |

| Seller BNPL (Merchant Cash Advance) |

| Cross-Border Trade BNPL |

Other Product Conditions

- Grace periods for payments

- Various fee structures

- Flexible availability criteria

- Effectively covered by product factories

Business Functions and Logic

Understanding the core operational components and data flows of BNPL systems (Primarily B2C)

B2C Onboarding Process

BNPL is embedded in the consumption process, with customer experience benchmarked against credit cards and online checkout. The B2C onboarding process must:

- Simplify documentation requirements

- Return results within seconds

- Eliminate manual intervention

Interactive B2C Onboarding Prototype

Key Data and Funds Flow

B2C BNPL data and funds flows are relatively simple, centered around three key business nodes: place order, merchant settlement, and customer repayment.

Customer (Consumer)

Behavior:

Selects BNPL at checkout (e.g., "Pay in 4") and confirms purchase.

Data Flow:

Selects payment method and agrees to repayment terms. Receives order confirmation and repayment schedule.

Funds Flow:

No upfront payment (owed $500 in installments).

Merchant (Retailer)

Behavior:

Sends order details (e.g., $500) and customer info to BNPL operator.

Data Flow:

Transmits order ID, amount, and customer data to BNPL operator. Receives order confirmation and books as revenue and A/R against BNPL.

Funds Flow:

No immediate payment received.

BNPL Operator

Behavior:

Runs soft credit check, approves/denies transaction, and notifies merchant.

Data Flow:

Receives order data, assesses risk via credit check, sends approval status to merchant and repayment terms to customer.

Funds Flow:

No funds transferred yet. Liability of $500 created (to cover merchant).

Customer (Consumer)

Behavior:

No action required.

Data Flow:

No data exchanged.

Funds Flow:

No funds deducted.

Merchant (Retailer)

Behavior:

Requests settlement from BNPL operator after order confirmation.

Data Flow:

Sends settlement request in batch (order ID and amount). Receives bank account notice, and credits A/R.

Funds Flow:

Receives $480 (assumes 4% BNPL fee).

BNPL Operator

Behavior:

Pays merchant minus fees (e.g., $480 net to merchant).

Data Flow:

Validates request, deducts fees, updates ledger, and confirms payment to merchant.

Funds Flow:

Pays $500 liability (to be recovered from customer).

Customer (Consumer)

Behavior:

Makes installment payments (e.g., $125 every 2 weeks) via app/bank transfer.

Data Flow:

Payment details sent to BNPL operator (e.g., amount, date).

Funds Flow:

Transfers $125 from bank account to BNPL.

Merchant (Retailer)

Behavior:

No action required.

Data Flow:

No data exchanged.

Funds Flow:

No funds involved.

BNPL Operator

Behavior:

Manages repayment schedule, sends reminders, applies late fees for missed payments.

Data Flow:

Updates customer's account, tracks payments, and manages collections if necessary.

Funds Flow:

Receives $125 installment from customer. Reduces A/R from customer.

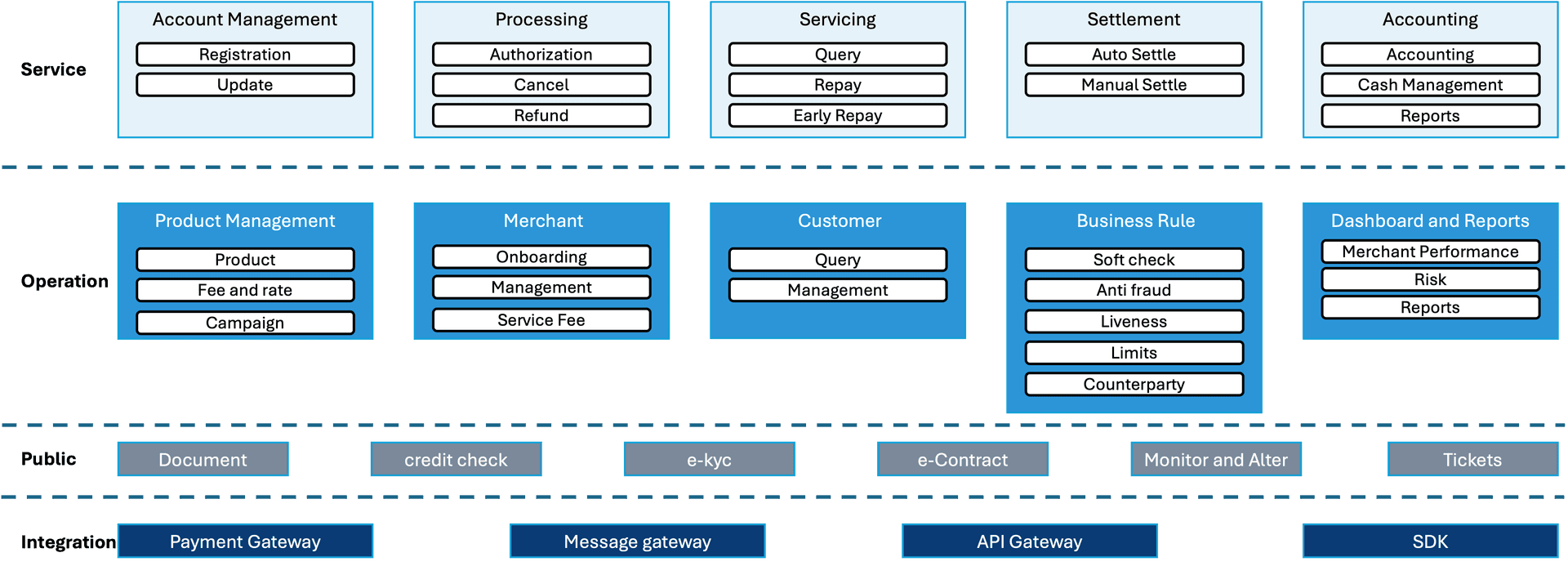

Solution Definition

Functional Architecture

A BNPL business system positioned for banks typically consists of four key layers: the Service Layer, Operation Layer, Public Layer, and Integration Layer.

Concept: A comprehensive, one-stop, white-label BNPL solution platform.

Essential Operations

- Account Management

- Processing

- Servicing

- Settlement

- Accounting

- Operation

- Risk Management

- Integration

Strategic Features

- Onboarding (Customer, Merchant)

- Authorization

- Fee/Rate Management

- Campaign Management

- Payment Gateway Integration

- Reporting

Value Proposition

- Offers flexibility and scalability

- Provides robust compliance support

- Includes comprehensive operational tools

- Ensures ease of integration

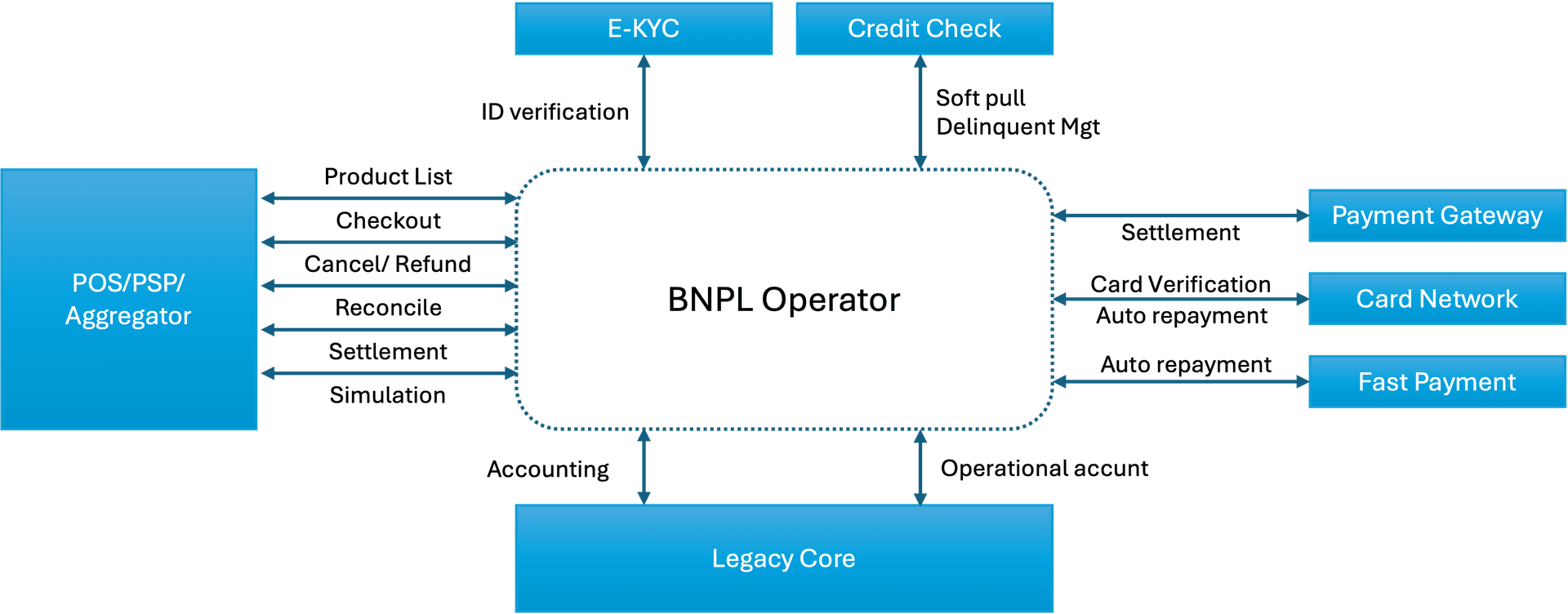

Integration Architecture

As an independent business system, BNPL needs comprehensive integration with:

For bank operators, it's recommended to adopt a dual-core model where the legacy system is used only for consolidating accounting data and managing BNPL operational accounts.

Differentiating Functional Emphasis: B2C vs. B2B

While many functions overlap, the emphasis and complexity differ significantly between B2C and B2B BNPL solutions:

Risk Management

- More sophisticated and crucial in B2B due to larger transaction values and potentially more complex business structures.

- Includes detailed KYB (Know Your Business).

- Involves more in-depth credit assessment.

Integration Depth & Complexity

- Deeper and more complex integrations are vital for B2B BNPL to seamlessly fit into existing business workflows and financial processes.

- Examples: ERP systems, accounting software, e-procurement platforms.

Customer Relationship Management (CRM)

- B2B relationships are typically longer-term and higher-value.

- Requires more personalized service, dedicated account management, and tailored support.

- Contrasts with the high-volume, often more transactional nature of B2C.

Customization & Flexibility

- B2B BNPL solutions often require greater customization to meet diverse and specific business needs and purchasing cycles.

- Aspects include: credit limits, repayment schedules, fee structures, and integration options.

Understanding these core business functions and their nuanced application in both B2C and B2B markets is essential for BNPL providers to build sustainable and successful operations, and for businesses to choose the right BNPL solutions to support their growth and financial health.

Solution Differentiation

Exploring value-added models and strategic directions for BNPL differentiation

Value-Added Models Beyond MVP (B2C Focus)

Different platforms attempt to provide new added value on top of the basic B2C BNPL business

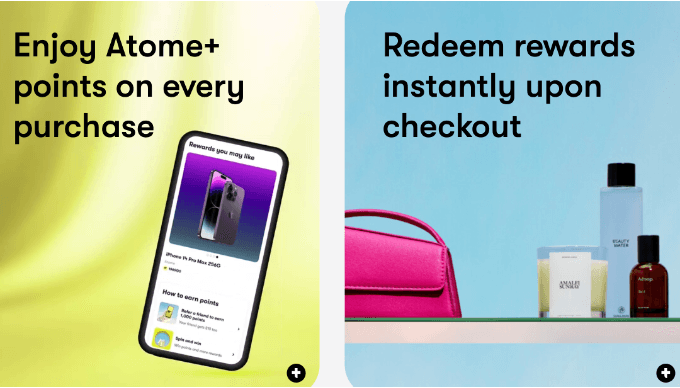

Points and Cashback

Rewarding customers with points or cash incentives for using BNPL services to enhance loyalty and increase usage frequency.

Merchant Enablement

Providing merchants with analytics, inventory management, and customer insights tools to optimize business operations.

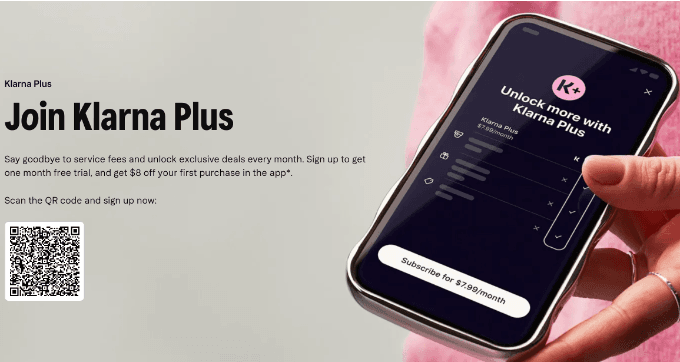

Premium Membership

Offering enhanced benefits such as higher credit limits, exclusive discounts, and priority customer service for frequent users.

Merchant Marketing

Helping merchants reach targeted customer segments and run promotions with measurable campaign effectiveness.

Strategic Directions for B2C Differentiation

Key initiatives to enhance B2C BNPL offerings and create competitive advantages

More Users (Consumers)

Strategies to attract and retain more end users on the B2C BNPL platform

More Merchants (Retailers)

Approaches to expand the merchant network and enhance merchant satisfaction in B2C

Low Operation Cost (B2C)

Methods to reduce operational expenses and improve efficiency in B2C BNPL

High ROI (B2C)

Strategies to maximize return on investment and financial performance in B2C BNPL

Strategic Directions for B2B BNPL Solutions

B2B BNPL success hinges on addressing unique commercial client needs. Unlike B2C's focus on mass consumer acquisition, B2B prioritizes deep integration, specialized services, and long-term business relationships for strategic differentiation.

Vertical Focus & Market Fit

Deep Vertical Specialization

Tailor BNPL to industry-specific needs (e.g., manufacturing, SaaS), aligning with unique payment cycles, procurement, and risk profiles for optimal relevance.

Cross-Border Trade Facilitation

Simplify and finance international trade by managing FX, compliance, and cross-border credit risks, unlocking global B2B market opportunities.

Value-Added Intelligence

Enhanced Data Analytics & Business Insights

Offer value beyond financing with tools for financial management: cash flow dashboards, spend analytics, benchmarks, and forecasting.

Working Capital Optimization

Position BNPL as a strategic tool for optimizing working capital, improving liquidity, enhancing supplier negotiations, and funding growth.

Scalable Infrastructure

Automation of Trade Finance Processes

Digitize and streamline trade finance, enhancing accessibility, speed, and efficiency, particularly for SMEs.

Seamless System Integration

Enable embedded financing via deep integration with ERPs, accounting software, and B2B platforms for streamlined workflows.

Ecosystem & Partnerships

Strategic Ecosystem Building

Foster key partnerships with B2B marketplaces, e-procurement platforms, and financial institutions for funding, risk sharing, and co-branded solutions.

Risk & Compliance Excellence

Sophisticated Risk Management & KYB

Invest in AI/ML for advanced credit underwriting and fraud detection. Implement robust KYB for trust and regulatory adherence.

BNPL Business Analysis: Conclusion & Key Takeaways

A synthesis of core dynamics, strategic pillars, and future outlook for the BNPL market.

I. Core Dynamics & Market Momentum

Fundamental Model:

BNPL provides deferred payment solutions, enhancing purchasing power for end-users (consumers/businesses) and increasing sales for merchants. Revenue is primarily driven by merchant fees, with various models for end-user interest or late fees.

Rapid Growth & Expansion:

The BNPL market is experiencing significant global growth across both consumer and business sectors. This is fueled by the digitization of commerce, demand for flexible financing options, and the need for improved cash flow management.

Ecosystem Interdependence:

Success relies on a well-integrated ecosystem comprising users, merchants, payment processors, technology providers/aggregators, and the BNPL operators themselves. Deep integration into e-commerce checkouts and business procurement systems is vital.

II. Key Operational & Strategic Pillars

User Experience & Automation:

Simplified, rapid onboarding processes and instant credit decisions are critical. Automation in underwriting, payment collection, and customer service is key to scalability and efficiency.

Sophisticated Risk Management:

Effective credit assessment (increasingly AI-driven) and robust fraud prevention mechanisms are paramount due to diverse user profiles and varying transaction complexities. Reliance on third-party data and specialized risk services is common.

Seamless Integration:

The ability to integrate smoothly with merchant platforms, existing payment infrastructures, ERP systems (for B2B), and other financial services is essential for broad market adoption and operational fluidity.

III. Differentiation & Future Outlook

Value Beyond Basic Financing:

Competitive differentiation is increasingly found in value-added services such as merchant analytics, loyalty programs, marketing support, and hyper-personalized offerings.

Continuous Product & Model Innovation:

The market sees ongoing evolution in product structures (e.g., flexible terms, dynamic credit limits, industry-specific solutions) and delivery channels (e.g., BNPL embedded in various payment forms like QR codes).

Evolving Regulatory Landscape:

BNPL is facing increasing regulatory scrutiny globally. Adaptability to changing rules and a strong focus on responsible lending, transparency, and fair practices are crucial for sustainable growth.

Strategic Imperatives:

- Network Expansion: Continuously growing the base of both users and participating merchants.

- Operational Excellence: Leveraging technology (especially AI and automation) to optimize costs, enhance service, and improve risk mitigation.

- Data-Driven Strategies: Utilizing transactional and behavioral data for improved credit modeling, personalized customer experiences, and valuable insights for merchant partners.

IV. B2C vs. B2B BNPL Distinctions

While sharing the core concept of deferred payment, B2B and B2C BNPL differ significantly:

| Feature | B2C BNPL | B2B BNPL |

|---|---|---|

| Target User | Individual Consumers | Businesses (SMEs, Large Enterprises) |

| Transaction Size | Generally Smaller | Typically Larger |

| Primary Motivation | Convenience, affordability | Working capital management, cash flow optimization |

| Credit Assessment | Simpler, often automated | More complex, in-depth business analysis |

| Repayment Terms | Short-term, often interest-free installments | More varied, can be longer-term, may involve fees/interest |

| Regulatory Focus | Consumer protection | Fair business lending, evolving |

Appendix

Key Feature Categories for BNPL Solutions

A comprehensive overview of essential BNPL features, highlighting key distinctions for B2C and B2B applications.

User & Entity Management

Core capabilities for onboarding, verifying, and managing all participants in the BNPL ecosystem, including individual consumers and business entities.

B2C Emphasis:

- Streamlined eKYC & fast consumer onboarding.

- Intuitive mobile-first user experience.

- Personalized consumer dashboards and notifications.

B2B Emphasis:

- Robust KYB, supplier verification, and due diligence.

- Role-based access control for business accounts.

- Self-service portals for merchant/supplier management.

Product & Offer Configuration

Flexible engines to define, customize, and manage diverse BNPL products, terms, and promotional offers for different market segments.

B2C Emphasis:

- Simple installment plans (e.g., Pay-in-4).

- Transparent fee structures and repayment schedules.

- Consumer loyalty programs and targeted campaigns.

B2B Emphasis:

- Complex term negotiation (net terms, volume discounts).

- Industry-specific product templates & pricing.

- Dynamic credit limits and financing for businesses.

Advanced Risk & Compliance

Sophisticated systems for credit assessment, fraud prevention, and ensuring adherence to regulatory requirements across jurisdictions.

B2C Emphasis:

- Automated soft credit checks for individuals.

- Real-time consumer fraud detection models.

- Compliance with consumer credit laws & data privacy.

B2B Emphasis:

- In-depth business credit underwriting & financial analysis.

- Invoice fraud prevention & business identity verification.

- Adherence to trade finance regulations and KYB/AML mandates.

Operational Automation

Technologies that streamline backend processes, reduce manual effort, and improve overall operational efficiency and scalability.

B2C Emphasis:

- Automated customer support via chatbots & AI.

- Efficient payment processing and automated reminders.

- Scalable digital collections processes & dispute resolution.

B2B Emphasis:

- Automated invoice reconciliation and complex dispute management.

- Streamlined B2B payment settlements & disbursements.

- Automated workflows for managing corporate accounts.

Data Intelligence & Analytics

Leveraging data to derive actionable insights, personalize experiences, manage risk, and inform strategic business decisions.

B2C Emphasis:

- Consumer behavior tracking and A/B testing for UX.

- Personalized product recommendations and marketing.

- Predictive analytics for consumer default risk & churn.

B2B Emphasis:

- Business spending pattern analysis & industry benchmarking.

- Cash flow forecasting tools for business clients.

- Supplier risk assessment & supply chain analytics.

Ecosystem Integration & APIs

Robust connectivity solutions to seamlessly integrate with merchant systems, payment networks, financial institutions, and other third-party services.

B2C Emphasis:

- Plug-and-play e-commerce platform integrations & SDKs.

- Consumer-facing payment gateway connections.

- Mobile app SDKs for easy BNPL adoption by merchants.

B2B Emphasis:

- Deep ERP, accounting, and e-procurement system integrations.

- B2B marketplace APIs & trade finance platform links.

- Secure APIs for corporate treasury and banking systems.

Professional Recommendations for Future BNPL Solutions

Forward-looking strategies to stay competitive and address market evolution.

Regulatory Compliance Framework

Develop flexible compliance modules that adapt to rapidly changing regulations across markets

- Automated regulatory reporting capabilities

- Jurisdiction-specific rule engines

- Compliance update system without core modifications

Cross-Border BNPL Solutions

Expand globally with multi-currency support and international transaction capabilities

- Transparent FX conversion

- International compliance frameworks

- Global payment network partnerships

Sustainability and Responsible Lending

Implement practices that prevent over-indebtedness and promote financial wellness

- Affordability check algorithms

- Financial wellness tools

- ESG compliance reporting

Next-Generation BNPL Innovations

Explore emerging technologies for enhanced transparency and new business models

- Blockchain-based solutions for fraud reduction

- Voice-enabled BNPL for conversational commerce

- Subscription-based models for recurring purchases